Key Milestones

ASEAN Finance Ministers first met in Phuket, Thailand, in March 1997, heeding the ASEAN Leaders’ decision that ASEAN shall move towards greater economic integration by building on existing economic cooperation activities, initiating new areas of cooperation and promoting closer cooperation in international fora. This meeting highlighted the importance of a concrete and closer cooperation in the area of finance as part of the building block to realise ASEAN’s goal of greater economic integration.

At the height of the Asian Financial Crisis in 1998, the ASEAN Surveillance Process was established as a mechanism for peer review among senior officials and Finance Ministers to facilitate closer collaboration on economic developments and policy issues in ASEAN.

In 2003, the Roadmap for ASEAN Integration in Finance (RIA-Fin) was established to further deepen ASEAN’s financial and monetary integration by 2015. The roadmap covers the (i) development of the ASEAN capital markets; (ii) liberalisation of the financial services; and (iii) liberalisation of the capital account

In March 2015, the 1st Joint Meeting of the ASEAN Finance Ministers and Central Bank Governors (AFMGM) convened in Kuala Lumpur, Malaysia. Held alongside the 19th ASEAN Finance Ministers Meeting (AFMM), AFMGM served as a strategic channel to deliberate on key issues of common concern and to widen the extent of discussions on policy dialogue on monetary and financial stability issues. The 1st Joint Meeting also reiterated their support for the activities under the Roadmap for Monetary and Financial Integration in ASEAN, which in turn would sustain the goals of the ASEAN Economic Community in 2015 and beyond.

In 2016, the 2nd AFMGM in Vientiane, Lao PDR, endorsed the Strategic Action Plans (SAPs) of the ASEAN Financial Integration 2016-2025. The SAPs included the promotion of financial integration, financial inclusion and financial stability in ASEAN and are in line with the ASEAN Economic Community Monitoring and Evaluation Framework. It also includes policy actions, targets and milestones to guide the implementation of the finance sector’s integration initiatives. Complementing this, at the 3rd AFMGM in 2017, the ministers and central bank governors adopted a monitoring and evaluation framework for the effective implementation of the AEC Blueprint 2025.

Areas of Cooperation

The ASEAN Finance is actively pursuing cooperation in various areas.

On further integration and resilience enhancement, ASEAN is working to re-establish the ASEAN Swap Arrangement (ASA), a multilateral currency swap arrangement, which was an early symbol of ASEAN financial integration first introduced in 1977. ASEAN is also working to promote greater use of local currencies in trade and investment, with the added benefit of greater resilience to market stress, through the implementation of the ASEAN Local Currency Transaction (LCT) Framework. Works are also being done in expanding payment linkages, with a particular focus on expanding the QR payment transaction.

On capital market development, the 12th AFMGM endorsed the ASEAN Capital Markets Forum (ACMF) Action Plan 2026–2030. The Action Plan focuses on sustainability, financial empowerment, enhanced regional integration, global competitiveness, and digitalisation.

Efforts are also being made to advance cooperation in taxation and treasury functions. The First ASEAN Treasury Forum (ATF) was launched in Bali in October 2024. The forum created working groups in public expenditure management, cash management, government accounting/reporting, and digital public financial management—key platforms for best-practice exchanges. ASEAN member states are making strides for enhanced bilateral treaties, raising BEPS Pillar 2 awareness, and implementing the Tax Identification Number (TIN) framework under the Common Reporting Standard.

The ASEAN Finance Track is also concerned with the sustainability issues. Since 2022, through the ASEAN Taxonomy Board (ATB), ASEAN has launched and regularly updated the ASEAN Taxonomy for Sustainable Finance, a common language and classification system for sustainable activities and projects across ASEAN Member States. Furthermore, the 12th AFMGM endorsed the ASEAN Infrastructure Fund (AIF) 2025–2028 Action Plan, which features strategic priorities such as expanding financing capacity, competitiveness, new facilities, and increased visibility and partnerships for enhanced sustainable infrastructure financing in ASEAN member states.

In implementing its mandate, the ASEAN Finance Track continuously reflects and makes efforts to make its process more effective and efficient. “Project Revive” initiative was launched in 2025 to improve governance, structural alignment, and process synergy—paving the way for agile and efficient policy coordination aligned with the ASEAN Strategic Plan 2026–2030 and the ASEAN Community Vision 2045.

ASEAN Finance Cooperation Web Portal (AFCWP)

AFCWP was launched in 2020 to serve as a platform for sharing key documents and public information related to the work of bodies in the ASEAN Finance Track and to provide public outreach on ASEAN Finance Track-related activities and initiatives.

AFCWP is managed by the Finance Integration Division, ASEAN Secretariat, under the guidance of the ASEAN Finance and Central Bank Deputies’ Meeting (AFCDM).

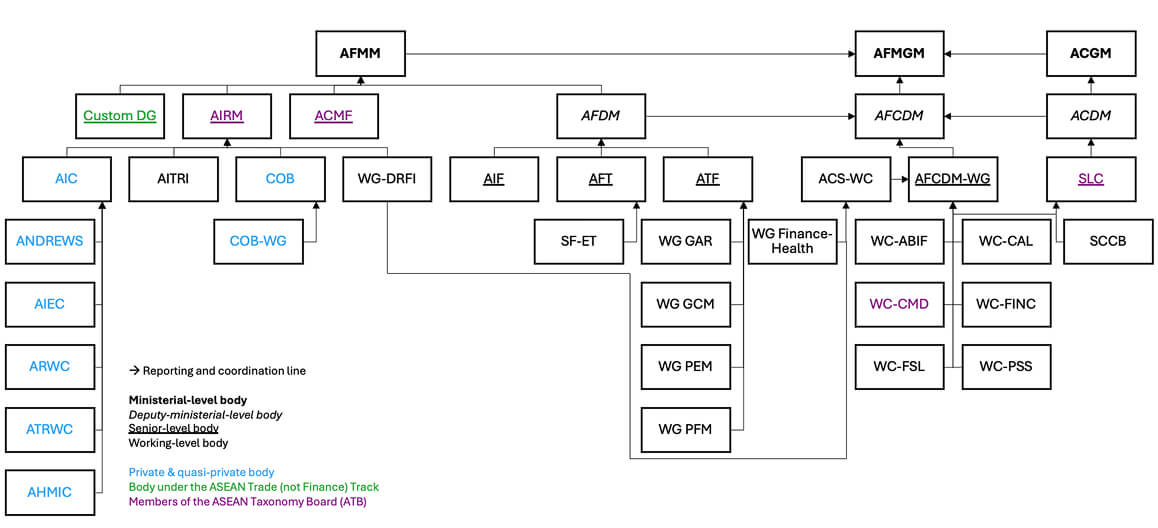

Structure of the ASEAN Finance Track

Sectoral Body

ASEAN Central Bank Deputies’ Meeting (ACDM)

Chair:

- Bangko Sentral ng Pilipinas

ACDM is a deputy-ministerial-level body consisting of deputy governors of the 11 AMS. ACDM convenes annually at the sidelines of AFMGM. The 21st ACDM took place in April 2025 in Kuala Lumpur, Malaysia. ACDM serves as a recommendatory body supporting financial integration, inclusion, and stability.

ASEAN Central Bank Governors’ Meeting (ACGM)

Chair:

- Bangko Sentral ng Pilipinas

ACGM is a platform for central bank governors of the 11 AMS. ACGM meets annually at the sidelines of AFMGM. The 21st ACGM was held in April 2025 in Kuala Lumpur, Malaysia. ACGM focuses on the ASEAN Banking Integration Framework (ABIF), capital account liberalisation, capital market development, financial inclusion, financial services liberalisation, and payment & settlement systems.

ASEAN Capital Markets Forum (ACMF)

Chair:

- Securities and Exchange Commission, Philippines

The ASEAN Capital Markets Forum (ACMF) is a high-level grouping of capital market regulators from all 11 ASEAN jurisdictions, namely Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Timor Leste, Thailand, and Vietnam.

Established in 2004 under the auspices of the ASEAN Finance Ministers, the primary responsibility of the ACMF is to develop a deep, liquid and integrated regional capital market.

Recognising the differing levels of development of member states, ACMF adopts a pragmatic approach in implementing its capital market initiatives, whereby member countries opt in to join the initiatives based on their market readiness.

The ACMF meets twice a year and is currently chaired by the Securities and Exchange Commission of the Philippines.

The above description is taken directly from the ACMF’s official website. See more: https://www.theacmf.org

Photo credit: Philippines NOC

ASEAN Cross-Sectoral Working Committee (ACS-WC)

Co-Chairs:

- Ministry of Finance, Malaysia

- Department of Health, Philippines

ACS-WC was proposed at the 10th AFMGM and was established at the 29th AFMM in April 2025 in Kuala Lumpur, Malaysia. ACS-WC promotes information exchange and collaboration across sectoral bodies for cross-sectoral initiatives involving the Finance Process, while avoiding duplication with sector-specific work. ACS-WC oversees the works of WG-DRFI and WG-FH.

Photo credit: Philippines NOC

ASEAN Finance and Central Bank Deputies’ Meeting (AFCDM)

Co-Chairs:

- Department of Finance, Philippines

- Bangko Sentral ng Pilipinas

AFCDM is a platform for finance and central bank deputies of the 11 AMS that meet annually at the sidelines of AFMGM. AFCDM was formally created in 2014, succeeding AFDM (1999–2013) and, before that, ASFOM (pre-1999). The 2025 AFCDM was held in April 2025 in Kuala Lumpur, Malaysia. AFCDM advises on all aspects of finance and central bank cooperation in support of AFMGM.

Photo credit: Ministry of Finance, Malaysia

ASEAN Finance and Central Bank Deputies’ Meeting-Working Group (AFCDM-WG)

Co-Chairs:

- Ms. Donalyn U. Minimo, Assistant Secretary, Department of Finance, Philippines

- Mr. Thomas Benjamin B. Marcelo, Managing Director, Bangko Sentral ng Pilipinas

AFCDM-WG is a senior-level body of finance ministries and central bank officials of the 11 AMS. AFCDM-WG meets annualy in the first quarter of each year. The 2026 AFCDM-WG was held in February 2026 in Panglao, Bohol, Philippines. AFCDM-WG is a key venue to discuss progress on RIA-Fin initiatives and senior/working-level works under AFDM, and to consider new proposals. AFCDM-WG’s wors are guided by the Finance Sectoral Plan under the ASEAN Economic Community Strategic Plan 2026-2030.

Photo credit: Philippines NOC

ASEAN Finance Deputies’ Meeting (AFDM)

Chair:

- Department of Finance, Philippines

AFDM is a deputy–ministerial platform of finance deputies from the 11 AMS that meets annually. The 2025 AFDM took place in April in Kuala Lumpur, Malaysia. AFDM supports AFMM in strengthening fiscal and finance cooperation to advance economic integration, sustainability, and resilience.

Photo credit: Ministry of Finance, Malaysia

ASEAN Finance and Health Ministers Meeting (AFHMM)

AFHMM is a ministerial-level platform comprising finance and health ministers of the 11 AMS. It typically meets biannually at the sidelines of the ASEAN Health Ministers’ Meeting. The 2nd AFHMM was held in Vientiane, Lao PDR, in August 2024, and reaffirmed collaboration between the finance and health sectors to advance sustainable healthcare financing and improve health outcomes across ASEAN.

Photo credit: Ministry of Finance, Indonesia

ASEAN Finance Ministers' and Central Bank Governors' Meeting (AFMGM)

Co-Chairs:

- Department of Finance, Philippines

- Bangko Sentral ng Pilipinas

AFMGM is the lead body of the ASEAN Finance Track, bringing together finance ministers and central bank governors from all 11 AMS. It convenes annually. The 12th AFMGM took place in April 2025 in Kuala Lumpur, Malaysia. Discussions covered the regional economic outlook, inclusive and sustainable growth, ASEAN’s role in regional cooperation and global engagement, regional financial integration and resilience, digital and financial innovation, and scaling up sustainable finance for a just transition. AFMGM maintains regular engagements with the private sector and international/regional financial institutions (e.g., ASEAN-BAC, EU-ABC, US-ABC, AMRO, World Bank, IMF, ADB, and others).

Photo credit: Ministry of Finance, Malaysia

ASEAN Finance Ministers’ Meeting (AFMM)

Chair:

- Department of Finance, Philippines

AFMM is a ministerial-level body of finance ministers from the 11 AMS that convenes annually. The 29th AFMM was held in April 2025 in Kuala Lumpur, Malaysia. AFMM’s agenda spans ASEAN financial cooperation priorities, including infrastructure finance, insurance cooperation, disaster risk financing and insurance, taxation, customs cooperation, and the ASEAN Single Window.

Photo credit: Ministry of Finance, Malaysia

ASEAN Forum on Taxation (AFT) & Sub-Forum on Excise Taxation (SF-ET)

Chair of AFT:

- Department of Finance, Philippines

Chair of SF-ET:

- Department of Finance, Philippines

AFT is a senior-level platform of tax officials from the 11 AMS, meeting twice a year. The 21st AFT & SF-ET took place in October 2025 in Penang, Malaysia. AFT addresses tax issues relevant to regional integration, including withholding tax and double taxation, information sharing and best practices, understanding differences in national tax rules, and supporting a network of DTAs among AMS.

SF-ET, under AFT, facilitates coordination on excise policy and administration, including data sharing, knowledge exchange, exploring common interests (e.g., product definitions, procedural standards, minimum burdens), improving administration, and capacity building.

Photo credit: Ministry of Finance, Malaysia

ASEAN Insurance Regulators Meeting (AIRM)

Chair:

- Mr Bou Chanphirou, Director General, Insurance Regulator of Cambodia

Vice Chair:

- Mr Ogi Prastomiyono, Chief Executive of Insurance, Guarantee Institution, and Pension Fund Supervision, Indonesia Financial Services Authority (OJK)

AIRM is a senior-level platform for insurance regulators of the 11 AMS. AIRM meets annually in the last quarter of the year. The 28th AIRM took place in Siem Reap, Cambodia, in November 2025. Established in 1998 under AFMM, AIRM assists the ministers in executing insurance cooperation, advises on approaches and areas for collaboration, implements ministerial decisions on insurance matters, and undertakes related tasks. AIRM also works closely with the private sector via the ASEAN Insurance Council (AIC); the annual AIRM features meetings such as:

- AIC & AIC-AIRM Joint Plenary

- The ASEAN Insurance Training and Research Institute (AITRI)

- ASEAN Council of Bureaux (COB)

- ASEAN Natural Disaster Research and Works Sharing (ANDREWS)

- ASEAN Insurance Education Committee (AIEC)

- ASEAN Reinsurance Working Committee (ARWC)

- ASEAN Takaful/Retakaful Working Committee (ATRWC)

- ASEAN Health and Medical Insurance Committee (AHMIC)

- Working Group on Disaster Risk Financing and Insurance (WG-DRF)

More:

- AIC’s website: https://aseaninsurancecouncil.org/

- AITRI’s website: https://www.aitri.org/aitri/

- COB’s website: https://www.aseancob.org/

Photo credit: Insurance Regulator of Cambodia

ASEAN Taxonomy Board (ATB)

Chair: Mr. Mardini Eddie, Deputy Managing Director (Monetary Operations, Development & International), Brunei Darussalam Central Bank

Host: Sustainable Finance Institute Asia

The ASEAN Taxonomy Board (ATB) develops, maintains, and promotes a multi-tiered ASEAN Taxonomy for Sustainable Finance (ASEAN Taxonomy). The ASEAN Taxonomy identifies economic activities that are sustainable and helps direct investment and funding towards a sustainable ASEAN.

The ATB was established under the auspices of the ASEAN Finance Ministers and Central Bank Governors’ Meeting (AFMGM) and is jointly driven by the ASEAN Capital Markets Forum (ACMF), the ASEAN Insurance Regulators’ Meeting (AIRM), the ASEAN Senior Level Committee on Financial Integration (SLC), and ASEAN Working Committee on Capital Market Development (WC-CMD).

More on SFIA’s webpage: https://www.sfinstitute.asia/asean-taxonomy/asean-taxonomy-board/

ASEAN Treasury Forum (ATF)

Chair: Department of Finance, Philippines

The ASEAN Treasury Forum (ATF) is a regional platform established by ASEAN Member States to strengthen cooperation, knowledge-sharing, and capacity building among national treasury institutions, focusing on core treasury functions such as public expenditure management, government cash management, government accounting and financial reporting, and the digitalisation of public financial management, including integrated financial management information systems. Endorsed by the ASEAN Finance Deputies and launched following a high-level meeting in April 2024, the ATF aims to provide a structured forum for senior treasury officials to exchange experiences, discuss policy and operational challenges, and identify priorities and collaborative activities to enhance the effectiveness, efficiency, and resilience of public financial management across the region.

ASEAN Directors-General of Customs (Customs DG)

The progress of initiatives under the purview of the ASEAN Directors-General of Customs Meeting is regularly reported to the Finance Track through the AFCDM-WG, AFDM, AFCDM, and AFMGM.

More: https://asean.org/tag/asean-directors-general-of-customs/

ASEAN Senior Level Committee (SLC) on Financial Integration

Co-Chairs:

- Ms. Filianingsih Hendarta, Deputy Governor, Bank Indonesia

- Mr. Pham Thanh Ha, Deputy Governor, State Bank of Viet Nam

SLC is comprised of ASEAN central bank deputies and officials, meeting twice a year. The 30th SLC was held in September 2025 in Yogyakarta, Indonesia.

Working Committee on ASEAN Banking Integration Framework (WC-ABIF)

Co-Chairs:

- Ms Reaksmy Mak, Director, Regulatory Policy & Risk Management Assessment Department, National Bank of Cambodia

- Mr Harizal Alias, Director, Financial Development & Innovation Department, Bank Negara Malaysia

WC-ABIF is a working-level committee of central bank officials from all 11 AMS. WC-ABIF meets twice a year. The 19th WC-ABIF was held in February 2026 in Panglao, Bohol, Philippines. The ABIF Task Force was upgraded to a formal WC in 2015 (SLC approval) and endorsed by ASEAN Central Bank Governors in April 2016. WC-ABIF facilitates the operationalisation of banking integration, promotes regulatory framework improvements, and supports cooperation/financial-stability arrangements for regional integration. WC-ABIF’s works are guided by the Finance Sectoral Plan under the ASEAN Economic Community Strategic Plan 2026-2030.

Photo credit: Philippines NOC

Working Committee on Capital Account Liberalisation (WC-CAL)

Co-Chairs:

- Mr Vatthana Sanoubane, Deputy Director General, Foreign Exchange Department, Bank of the Lao PDR

- Mr Thomas Benjamin Marcelo, Managing Director, Bangko Sentral ng Pilipinas

WC-CAL is a working-level committee of ministry of finance and central bank officials from the 11 AMS. WC-CAL meets twice a year. The 51st WC-CAL took place in February 2026 in Panglao, Bohol, Philippines. WC-CAL works to advance capital account liberalisation, and reinforces dialogue and information exchange on capital flows statistics and measures across AMS. WC-CAL’s works are guided by its Finance Sectoral Plan under the ASEAN Economic Community Strategic Plan 2026-2030.

Photo credit: Philippines NOC

Working Committee on Capital Market Development (WC-CMD)

Co-Chairs:

- H.E. Sou Socheat, Director General, Securities and Exchange Regulator of Cambodia

- Ms. Dawn Chew, Executive Director, International Department, Monetary Authority of Singapore

WC-CMD is a working-level committee of capital market authority, finance ministry, and central bank officials of the 11 AMS. WC-CMD meet twice a year and has regular engagement with the ASEAN Capital Market Forum (ACMF). The 2026-I WC-CMD Meeting was held in February 2026 in Panglao, Bohol, Philippines. Established in 2003, WC-CMD builds capacity and lays the groundwork for capital market development, with the long-term goal of fostering cross-border collaboration among ASEAN markets. WC-CMD’s works are guided by the Finance Sectoral Plan under the ASEAN Economic Community Strategic Plan 2026-2030.

Photo credit: Philippines NOC

Working Committee on Financial Inclusion (WC-FINC)

Co-Chairs:

- Mr Roaizan Johari, Head of Financial Development, Brunei Darussalam Central Bank

- Ms Nuttathum Chutasripanich, Director, Financial Institutions Strategy Department, Bank of Thailand

WC-FINC is a working-level committee of finance ministry and central bank officials of the 11 AMS. WC-FINC meets twice a year. The 21st WC-FINC took place in Panglao, Bohol, Philippines, in February 2026. Established in 2016, WC-FINC advances regional financial inclusion through coordinated initiatives, collaboration with relevant bodies, and sharing of experiences to support national financial inclusion strategies and programs.

Photo credit: Philippines NOC

Working Committee on Financial Services Liberalisation (WC-FSL)

Co-Chairs:

- Mrs Phengkhiem Xayakeo, Deputy Director General, International Finance & Cooperation Department, Ministry of Finance, Lao PDR

- Ms Carlyn Diaz, Director III, International Finance Policy Office, Department of Finance, The Philippines

WC-FSL is a working-level committee of relevant authorities across the 11 AMS. The 84th WC-FSL was held in February 2026 in Panglao, Bohol, Philippines. WC-FSL was established in 2003 and its wors are guided by the Finance Sectoral Plan under the ASEAN Economic Community Strategic Plan 2026-2030. WC-FSL seeks a more integrated financial services sector through progressive liberalisation, information sharing, and facilitation of ASEAN’s engagements with dialogue partners.

Photo credit: Philippines NOC

Working Committee on Payment and Settlement System (WC-PSS)

Co-Chairs:

- Ms Faadzilah Abu Bakar, Executive Director, Regulatory II (Capital Markets & Payment Services), Brunei Darussalam Central Bank

- Mr Qaiser Iskandar bin Anwarudin, Director, Payment Services Policy Department, Bank Negara Malaysia

WC-PSS is a working-level committee of central bank and monetary authority officials of the 11 AMS, meeting twice a year. The 32nd WC-PSS was held in February 2026, Panglao, Bohol, Philippines. Established in 2010, WC-PSS studies and recommends policies for the development and harmonisation of ASEAN payment and settlement systems in support of the Finance Sectoral Plan under the ASEAN Economic Community Strategic Plan 2026-2030.

Photo credit: Philippines NOC

Working Group on Disaster Risk Financing and Insurance (WG-DRFI)

Chair: Dato’ Zamzuri bin Abdul Aziz, Deputy Secretary General of Treasury (Policy), Ministry of Finance, Malaysia

WG-DRFI is a working-level body of finance ministry and relevant disater risk financing and insurance officials from all 11 AMS. WG-DRFI meets twice a year at the sidelines of AFCDM-WG and AIRM. WG-DRFI works closely with AIRM as well as ASEAN Committee on Disaster Management.

Formerly the ACSCC-DRFI, it was re-established as WG-DRFI in February 2025 (18th ACSCC-DRFI, Penang). WG-DRFI facilitates implementation of the ADRFI Roadmap, strengthens collaboration among sectoral bodies to ensure effective delivery, and monitors/assesses progress of ADRFI workplans. WG-DRFI’s works are also guided by the Finance Sectoral Plan under the ASEAN Economic Community Strategic Plan 2026-2030.

Photo credit: Philippines NOC

Working Group on Finance-Health Collaboration (WG-FHC)

Co-Chairs:

- Ms Carlyn A. Diaz, Director III, International Finance Policy Office, International Finance Group, Department of Finance, Philippines

- Mr Roderick Napulan, Director IV, Department of Health, Philippines

WG-FHC is a working-level body of finance and health officials across the 11 AMS. WG-FHC was established at the 2nd AFHMM in August 2024 in Vientiane, Lao PDR and had its inaugural meeting virtually in December 2025.

WG-FHC’s tasks include establishing regular coordination between finance and health bodies; collaborating with international organisations/dialogue partners for capacity building; coordinating with other sectoral WGs; commissioning research/policy studies on financing health challenges; and others as guided by the ASEAN Economic Community Strategic Plan 2026-2030.

Photo credit: Philippines NOC

Brunei Darussalam

Brunei Darussalam Cambodia

Cambodia Indonesia

Indonesia Lao PDR

Lao PDR Malaysia

Malaysia Myanmar

Myanmar Philippines

Philippines Singapore

Singapore Thailand

Thailand Timor-Leste

Timor-Leste Viet Nam

Viet Nam